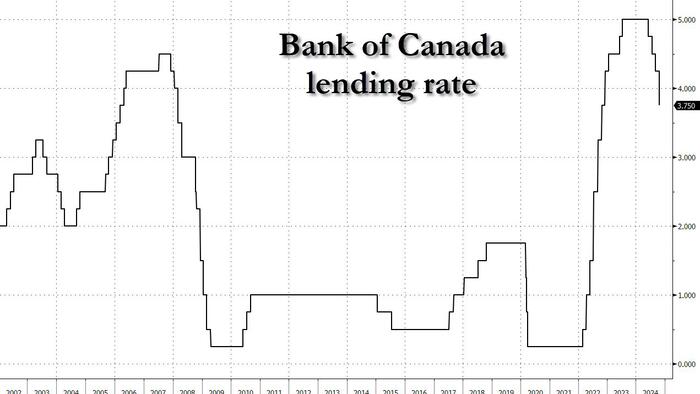

The 50 basis-point cut suggests a new phase of monetary policy easing, where policymakers focus on returning interest rates to more neutral levels In keeping up with the global easing frenzy, and also in keeping with its promises from last month when it said to "expects further cuts", moments ago the Bank of Canada - home of what may be the world's biggest housing bubble - stepped up the pace of interest-rate cuts and signaled that the post-pandemic era of high inflation is over when the central bank cut the benchmark overnight rate to 3.75% on Wednesday, the biggest reduction in borrowing costs since March 2020 during the early days of the pandemic.

https://www.zerohedge.com/markets/bank-canada-slashes-rates-4th-straight-month-biggest-rate-cut-covid

https://www.zerohedge.com/markets/bank-canada-slashes-rates-4th-straight-month-biggest-rate-cut-covid

The 50 basis-point cut suggests a new phase of monetary policy easing, where policymakers focus on returning interest rates to more neutral levels In keeping up with the global easing frenzy, and also in keeping with its promises from last month when it said to "expects further cuts", moments ago the Bank of Canada - home of what may be the world's biggest housing bubble - stepped up the pace of interest-rate cuts and signaled that the post-pandemic era of high inflation is over when the central bank cut the benchmark overnight rate to 3.75% on Wednesday, the biggest reduction in borrowing costs since March 2020 during the early days of the pandemic.

https://www.zerohedge.com/markets/bank-canada-slashes-rates-4th-straight-month-biggest-rate-cut-covid

0 Comments

0 Shares

85 Views

0 Reviews