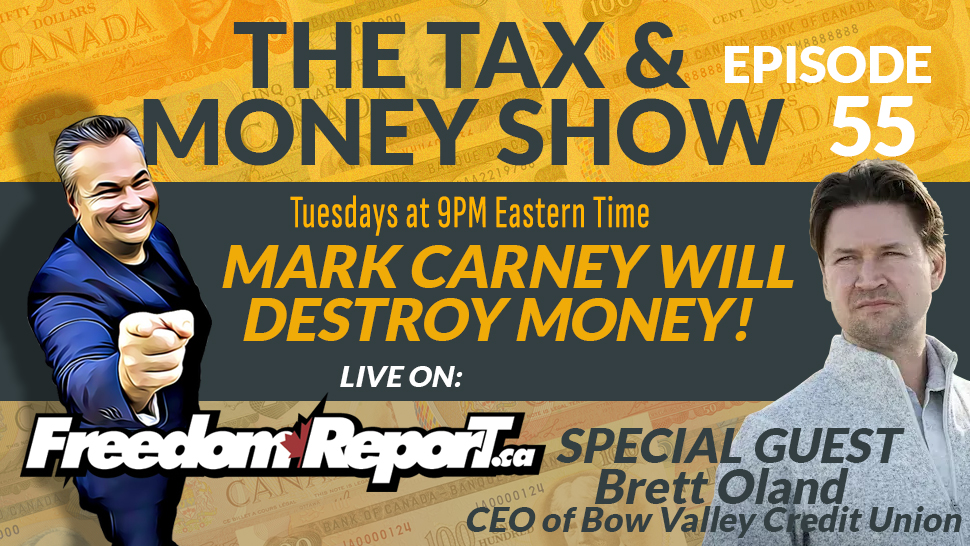

The Tax and Money Show with Kevin J. Johnston is back with another explosive episode! In Episode 55, we dive deep into the financial chaos being orchestrated by none other than Mark Carney, the unelected figure who is on a mission to destroy the Canadian dollar and the economy as we know it. Joining us for this hard-hitting discussion is a man who knows the banking world inside and out—Brett Oland, CEO of Bow Valley Credit Union. As a chartered accountant and expert in corporate finance, Brett brings unique insights into the rapidly evolving financial landscape, the dangers of centralized banking, and how Canadians can fight back against financial tyranny.

STOP PAYING TAX IN CANADA FOREVER! www.KevinJJohnston.com

If you think Canada’s banking and taxation system is built to benefit you, think again! In this episode, we expose the hidden agendas behind financial policies that are quietly draining the wealth of hardworking Canadians. Mark Carney and the elite financial players are pushing for digital currency control, eroding cash-based freedom, and tightening the CRA’s grip on your income. But there are ways to protect your money, safeguard your assets, and break free from the system designed to keep you in debt. Brett Oland will reveal insider secrets on how credit unions differ from big banks and why they could be the last safe haven for Canadians who value financial independence.

STOP PAYING TAX IN CANADA FOREVER! www.KevinJJohnston.com

Kevin J. Johnston is Canada’s #1 income and corporate tax expert, and he is the only man that the CRA truly fears. Why? Because he exposes the truth about how Canadian tax laws are rigged against citizens and businesses. The government doesn’t want you to know how to legally keep more of your money and avoid getting crushed by excessive taxation. This episode is packed with actionable strategies to reduce your tax burden, legally minimize CRA interference, and secure financial freedom for you and your family.

STOP PAYING TAX IN CANADA FOREVER! www.KevinJJohnston.com

Don’t let the government and big banks dictate your financial future! If you’re tired of being overtaxed, manipulated by the CRA, and forced into a financial system that steals from the middle class, this episode is a must-watch. Brett Oland and Kevin J. Johnston break down practical steps that Canadians can take right now to escape financial slavery. From credit unions to offshore banking strategies, from legal tax avoidance to asset protection, this episode arms you with the knowledge you need to fight back and win.

Trending Hashtags:

#TaxRevolt #CanadaTax #IncomeTax #TaxHacks #BankingFreedom #FinancialIndependence #NoMoreCRA #CanadianBanking #TaxFreeLife #EndHighTaxes #StopOverTaxation #WealthProtection #MarkCarney #BigBankScam #CreditUnion #CashIsKing #FinancialFreedom #DebtFreeCanada #TaxationIsTheft #DigitalCurrency

Comma-Separated Hashtags:

TaxRevolt, CanadaTax, IncomeTax, TaxHacks, BankingFreedom, FinancialIndependence, NoMoreCRA, CanadianBanking, TaxFreeLife, EndHighTaxes, StopOverTaxation, WealthProtection, MarkCarney, BigBankScam, CreditUnion, CashIsKing, FinancialFreedom, DebtFreeCanada, TaxationIsTheft, DigitalCurrency

The Tax and Money Show with Kevin J. Johnston is back with another explosive episode! In Episode 55, we dive deep into the financial chaos being orchestrated by none other than Mark Carney, the unelected figure who is on a mission to destroy the Canadian dollar and the economy as we know it. Joining us for this hard-hitting discussion is a man who knows the banking world inside and out—Brett Oland, CEO of Bow Valley Credit Union. As a chartered accountant and expert in corporate finance, Brett brings unique insights into the rapidly evolving financial landscape, the dangers of centralized banking, and how Canadians can fight back against financial tyranny.

STOP PAYING TAX IN CANADA FOREVER! www.KevinJJohnston.com

If you think Canada’s banking and taxation system is built to benefit you, think again! In this episode, we expose the hidden agendas behind financial policies that are quietly draining the wealth of hardworking Canadians. Mark Carney and the elite financial players are pushing for digital currency control, eroding cash-based freedom, and tightening the CRA’s grip on your income. But there are ways to protect your money, safeguard your assets, and break free from the system designed to keep you in debt. Brett Oland will reveal insider secrets on how credit unions differ from big banks and why they could be the last safe haven for Canadians who value financial independence.

STOP PAYING TAX IN CANADA FOREVER! www.KevinJJohnston.com

Kevin J. Johnston is Canada’s #1 income and corporate tax expert, and he is the only man that the CRA truly fears. Why? Because he exposes the truth about how Canadian tax laws are rigged against citizens and businesses. The government doesn’t want you to know how to legally keep more of your money and avoid getting crushed by excessive taxation. This episode is packed with actionable strategies to reduce your tax burden, legally minimize CRA interference, and secure financial freedom for you and your family.

STOP PAYING TAX IN CANADA FOREVER! www.KevinJJohnston.com

Don’t let the government and big banks dictate your financial future! If you’re tired of being overtaxed, manipulated by the CRA, and forced into a financial system that steals from the middle class, this episode is a must-watch. Brett Oland and Kevin J. Johnston break down practical steps that Canadians can take right now to escape financial slavery. From credit unions to offshore banking strategies, from legal tax avoidance to asset protection, this episode arms you with the knowledge you need to fight back and win.

Trending Hashtags:

#TaxRevolt #CanadaTax #IncomeTax #TaxHacks #BankingFreedom #FinancialIndependence #NoMoreCRA #CanadianBanking #TaxFreeLife #EndHighTaxes #StopOverTaxation #WealthProtection #MarkCarney #BigBankScam #CreditUnion #CashIsKing #FinancialFreedom #DebtFreeCanada #TaxationIsTheft #DigitalCurrency

Comma-Separated Hashtags:

TaxRevolt, CanadaTax, IncomeTax, TaxHacks, BankingFreedom, FinancialIndependence, NoMoreCRA, CanadianBanking, TaxFreeLife, EndHighTaxes, StopOverTaxation, WealthProtection, MarkCarney, BigBankScam, CreditUnion, CashIsKing, FinancialFreedom, DebtFreeCanada, TaxationIsTheft, DigitalCurrency