Your Questions Answered Part 46 - The Kevin J. Johnston Show!

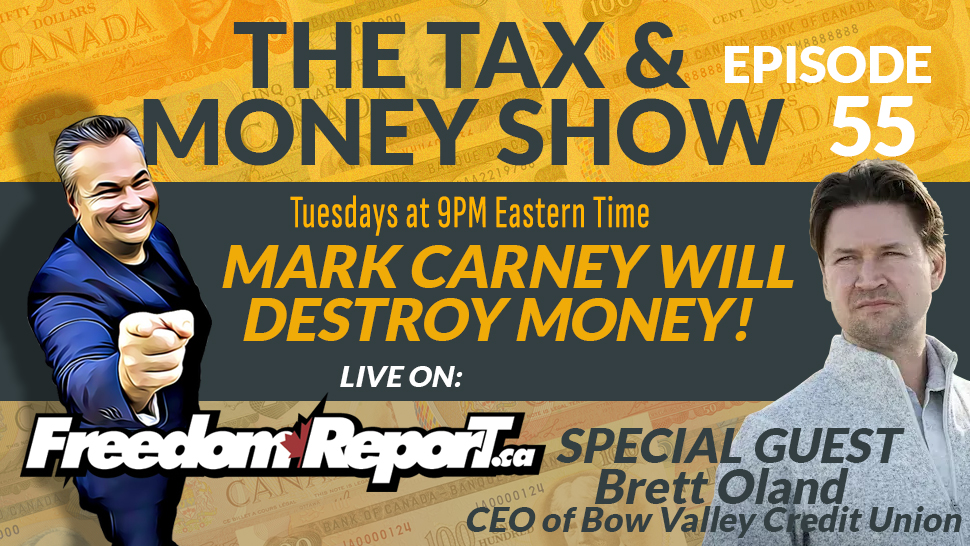

Tuesdays at 9PM EST LIVE ON:

https://rumble.com/kevinjjohnston/live

www.FreedomReport.ca

www.X.com/KevinTheJackal

www.X.com/KJJTV13

The Kevin J. Johnston Show has made waves once again with its special episode, "Your Questions Answered Part 46." This interactive session invites the audience to ask anything—yes, anything—and promises no holds barred when it comes to the answers. Known for his bold and unfiltered approach, Kevin J. Johnston dives headfirst into topics ranging from politics

to commerce

, leaving no stone unturned. Fans of the show eagerly anticipate each instalment of this series, where Johnston demonstrates his skill in connecting with people and delivering sharp, insightful commentary.

BOOK YOUR CONSULTATION NOW: www.KevinJJohnston.com

Kevin J. Johnston is no stranger to controversy. As a Canadian podcaster, he’s built a reputation as a straight-talking public figure, often described as the best public speaker

Canada has ever produced. Whether tackling tough topics or offering business insights, Johnston’s ability to captivate and inform his audience is unmatched. His confidence and charisma have earned him a loyal following and a platform that continues to grow, despite polarizing opinions about his content.

BOOK YOUR CONSULTATION NOW: www.KevinJJohnston.com

Beyond podcasting, Kevin J. Johnston shines as an expert in income tax and corporate tax

. With a deep understanding of Canada’s financial systems, he has positioned himself as the go-to advisor for Canadians navigating complex financial landscapes.

Whether you’re an individual seeking advice or a corporation in need of strategic tax planning, Kevin’s knowledge is invaluable. Episodes like Your Questions Answered showcase not only his sharp intellect but also his willingness to empower his audience with practical, real-world knowledge.

BOOK YOUR CONSULTATION NOW: www.KevinJJohnston.com

Top 20 Trending Hashtags

#RealEstateInvesting,

#CryptoNews,

#GoldMarket,

#SilverInvestment,

#WealthBuilding,

#TaxStrategy,

#CanadianFinance,

#USCorporateTax,

#RealEstateTips,

#GoldSilverCrypto,

#BankingTrends,

#InvestmentAdvice,

#FinancialFreedom,

#MoneyMatters,

#RealEstateCanada,

#CryptoTrading,

#PreciousMetals,

#IncomeTaxHelp,

#FinancialPlanning,

#EconomicTrends

Comma-Delimited List

RealEstateInvesting, CryptoNews, GoldMarket, SilverInvestment, WealthBuilding, TaxStrategy, CanadianFinance, USCorporateTax, RealEstateTips, GoldSilverCrypto, BankingTrends, InvestmentAdvice, FinancialFreedom, MoneyMatters, RealEstateCanada, CryptoTrading, PreciousMetals, IncomeTaxHelp, FinancialPlanning, EconomicTrends

www.X.com/KevinJJohnstonX

www.TikTok.com/RealKevinJJohnston

www.Facebook.com/OfficialKevinJJohnston

Your Questions Answered Part 46 - The Kevin J. Johnston Show!

Tuesdays at 9PM EST LIVE ON:

https://rumble.com/kevinjjohnston/live

www.FreedomReport.ca

www.X.com/KevinTheJackal

www.X.com/KJJTV13

The Kevin J. Johnston Show has made waves once again with its special episode, "Your Questions Answered Part 46." This interactive session invites the audience to ask anything—yes, anything—and promises no holds barred when it comes to the answers. Known for his bold and unfiltered approach, Kevin J. Johnston dives headfirst into topics ranging from politics 🏛️ to commerce 💼, leaving no stone unturned. Fans of the show eagerly anticipate each instalment of this series, where Johnston demonstrates his skill in connecting with people and delivering sharp, insightful commentary.

BOOK YOUR CONSULTATION NOW: www.KevinJJohnston.com

Kevin J. Johnston is no stranger to controversy. As a Canadian podcaster, he’s built a reputation as a straight-talking public figure, often described as the best public speaker 🇨🇦 Canada has ever produced. Whether tackling tough topics or offering business insights, Johnston’s ability to captivate and inform his audience is unmatched. His confidence and charisma have earned him a loyal following and a platform that continues to grow, despite polarizing opinions about his content. 🎤✨

BOOK YOUR CONSULTATION NOW: www.KevinJJohnston.com

Beyond podcasting, Kevin J. Johnston shines as an expert in income tax and corporate tax 💰. With a deep understanding of Canada’s financial systems, he has positioned himself as the go-to advisor for Canadians navigating complex financial landscapes. 💼📈 Whether you’re an individual seeking advice or a corporation in need of strategic tax planning, Kevin’s knowledge is invaluable. Episodes like Your Questions Answered showcase not only his sharp intellect but also his willingness to empower his audience with practical, real-world knowledge. 💡

BOOK YOUR CONSULTATION NOW: www.KevinJJohnston.com

Top 20 Trending Hashtags

#RealEstateInvesting, #CryptoNews, #GoldMarket, #SilverInvestment, #WealthBuilding, #TaxStrategy, #CanadianFinance, #USCorporateTax, #RealEstateTips, #GoldSilverCrypto, #BankingTrends, #InvestmentAdvice, #FinancialFreedom, #MoneyMatters, #RealEstateCanada, #CryptoTrading, #PreciousMetals, #IncomeTaxHelp, #FinancialPlanning, #EconomicTrends

Comma-Delimited List

RealEstateInvesting, CryptoNews, GoldMarket, SilverInvestment, WealthBuilding, TaxStrategy, CanadianFinance, USCorporateTax, RealEstateTips, GoldSilverCrypto, BankingTrends, InvestmentAdvice, FinancialFreedom, MoneyMatters, RealEstateCanada, CryptoTrading, PreciousMetals, IncomeTaxHelp, FinancialPlanning, EconomicTrends

www.X.com/KevinJJohnstonX

www.TikTok.com/RealKevinJJohnston

www.Facebook.com/OfficialKevinJJohnston